Texas Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament (aka Will) is a legal document that describes a person's final wishes pertaining to his or her assets. In other words, a Will designates how your property will be distributed after you die. A Will is often the cornerstone of your estate plan.

Reasons to Have a Will

There are many reason to have a Will. Here are just a few:

- To designate a guardian for your minor children. If you have kids under 18, or older children with disabilities, it’s important to make sure they are provided for after you die. A Will allows you to decide who will raise your children, if your spouse or co-parent does not survive you. If you don’t have a Will, a court may be asked to make this decision, choosing either a family member or a state-appointed guardian.

- Distribute your assets according to your preferences. Who would you rather decide the beneficiaries of your estate — you, or the State of Texas? If you die without a Will, the state probate court will determine how best to allocate your assets using a statutory formula, and they may not make the same choices you would make. For example, rather than leaving all of your estate to a spouse, parent or child, perhaps there are certain items you would like a specific child, relative, or friend to have. Maybe you want to make sure your daughter gets your engagement ring, and your son receives your record collection. Or, perhaps you spent many hours fishing with a beloved nephew, and you would like him to inherit your boat. According to U.S. law, you have the freedom to decide what will happen to your assets when you die. But, to claim this freedom, you must create a Will.

- Make sure your wishes are legally enforceable. Jotting your wishes down on paper and adding a signature at the bottom may not be enough. True, a handwritten Will may be admitted to probate in Texas. If it is in your own handwriting and signed, it may be even be accepted. However, there is a chance it may not be recognized as valid by the court. Or, it may fail to properly allocate all of your assets. It will also be more expensive to process than a traditional, formal Will.

- Reduce administrative burdens for surviving family members. Your loved ones may find it difficult to focus on administering your estate when they are in the process of grieving your loss. Wills make distribution of assets easier for your beneficiaries. They can also reduce the length of the probate process.

- Minimize disputes among family members. Many a Hollywood movie plot has revolved around family members’ bickering over the assets of a deceased relative. It may make for an entertaining scene on screen, but it’s nothing you’d want to witness in real life. Having a clear Will can help prevent arguments between children, spouses and other family members.

- Avoid paying excessive taxes. Without legal assistance, either from an attorney or a trustworthly online Will company, you may not know how to minimize the tax burden on your death. A well-drafted Will can reduce estate taxes, and even allow facilitate the creation of a trust after your death..

- Dictate who will carry out your last wishes. From cancelling credit cards, to contacting banks and businesses, to paying bills and administering the distribution of your estate, there’s a lot to take care of after you die. An executor carries out these tasks, among others — and if you don’t appoint one in your Will, the courts will do so for you. If you have someone in mind who is ethical, reliable and well organized, you can ask him or her to be your executor, and make it official in your Will.

- Create a Plan for Business Succession. Entrepreneurs work hard to create their businesses — so if you own a small business, it’s important to outline a plan for what to do with it after you die. Succession planning, business debt payment, and allocation of future earnings can be an important part of your Will.

- Leave a Legacy. Even after you die, you can continue to make a difference by leaving charitable gifts to nonprofit organizations you support. Gifts up to $13,000 are not subject to estate tax — enabling your gifts to go further toward supporting worthy causes.

What Happens If I Don’t Have A Will?

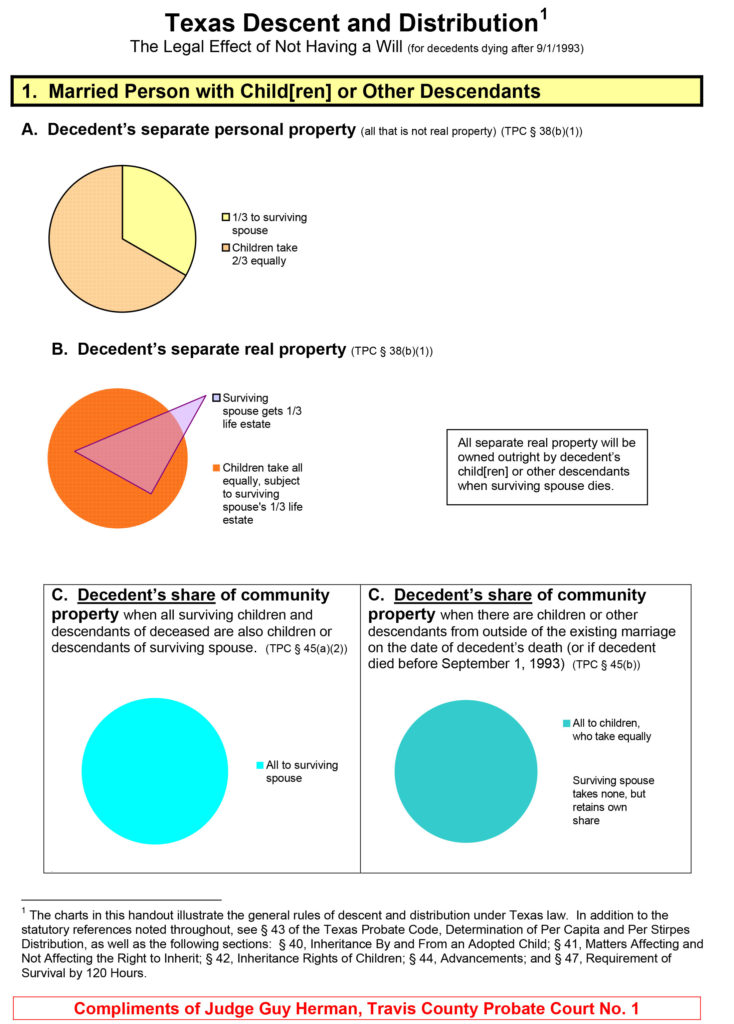

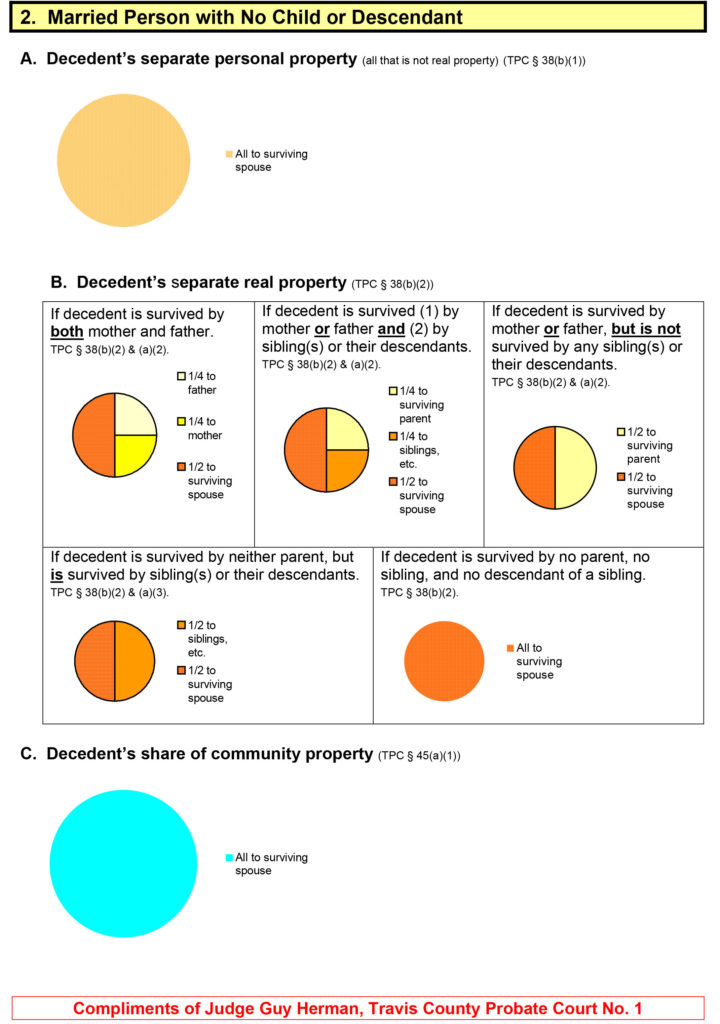

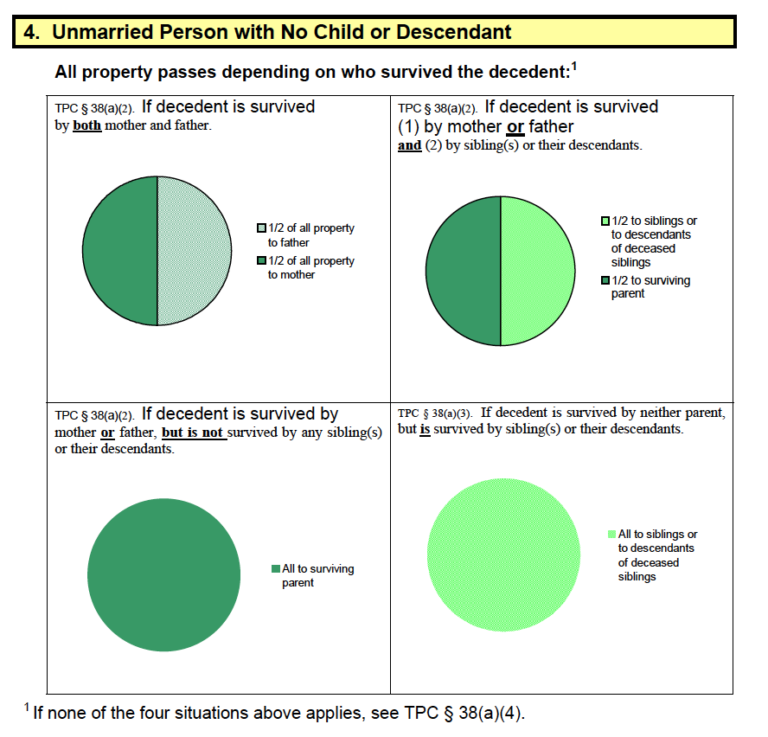

Imagine you died today. Who would inherit your home, vehicle, and property? Who would care for your children? If you don’t have a Will, your estate would be divided among your relatives through a process called “intestate succession,” according to Texas law. While you may trust that your property would be allocated fairly, you might be surprised to learn who gets what — and how much more difficult the process could be for your relatives and loved ones when you don’t have a Will in place. Here’s an overview of how the state of Texas typically allocates property when you die without a Will:

When Should I Revisit A Previous Will?

There is no hard and fast rule of when you should revisit your Will, but there are a few life events that would make a revisit advisable. Divorce, having children, starting a new business are all good reasons. Click here to see more reasons to revisit your Will.

How do I obtain a Will?

It’s easier and less expensive than you might think. For a flat fee of $225, you can get a custom attorney prepared Will.

Am I Eligible?

| Document | Price |

|---|---|

| Will | $225 |

| Durable POA | $40 |

| Medical POA | $40 |

| Living Will/Advance Directive | $40 |

| Transfer on Death Deed | $200 |

Create Your Last Will and Testament

It takes a few minutes to order and only costs $225.Start Now